Property Taxes & Utilities

Property Taxes & Utilities

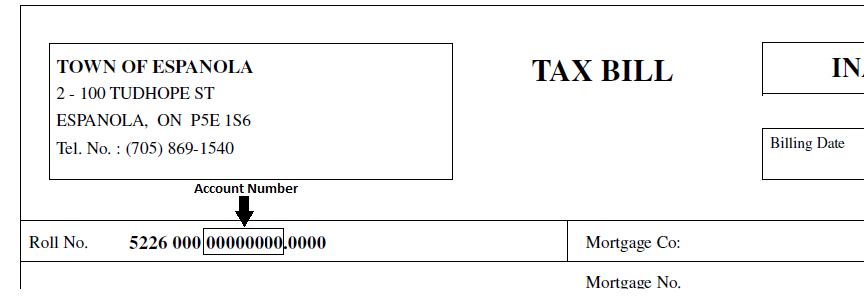

Each year the Town of Espanola collects municipal taxes and water & sewer utility fees from property owners. The Municipal Property Assessment Corporation's (MPAC) determines your property's assessment value, and we use that value to calculate your property tax rate. Contact MPAC for questions on your property's assessed value.